Monetary aggregates are measures of money supply used by economists. Broadly speaking, the State Bank of Pakistan defines three formal measures of money supply:

- M1

This is the narrowest form of measure, and the most liquid, and consists of circulated notes in the economy and transferable deposits that carry no restriction or penalty if one demands exchange for them (such as current account deposits).

- M2

Generally referred to as broad money, M2 is a superset of M1 and coins in circulation, short-term financial instruments (other than shares), and other transferable deposits that may carry restrictions or penalties (that is, they are not readily or freely exchangeable at demand).

- M3

This is the broadest form of money supply, consisting of everything in M2, along with deposits in non-bank institutions and government schemes (for example, prize bonds).

Which monetary aggregate to use during modeling?

Any of these can be used as a variable for money supply in the economy during analysis of any sort. There is a caveat, however. If these measures are not moving together (say, they have different trends), then an analysis might give different results depending on the type of money aggregate used.

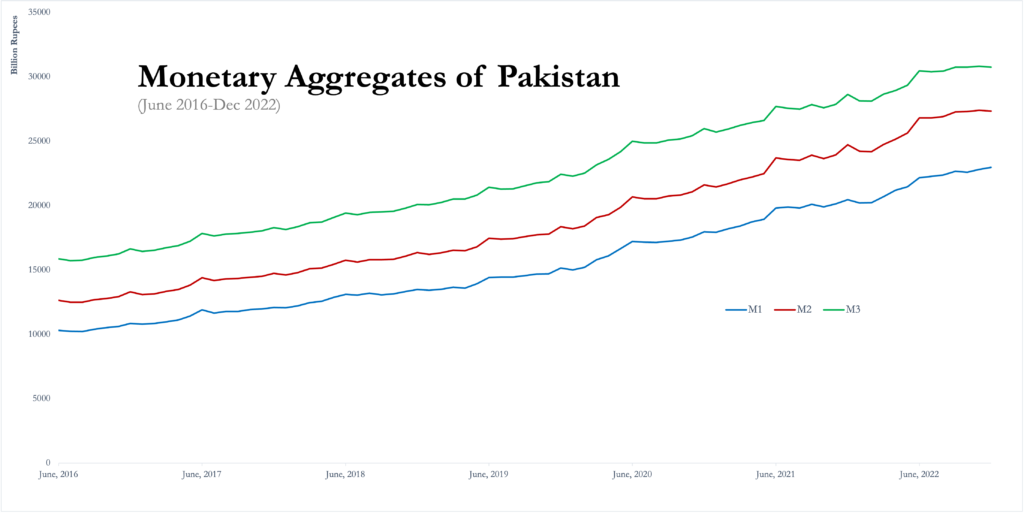

We extracted monthly data for monetary aggregates of Pakistan, released by the State Bank, from June 2016 to December 2022. These are visualized below:

As the graph shows:

- The monetary aggregates are principally moving together.

- At the beginning of the series, we can observe that the gap between M1 and M2 is smaller than the gap between M2 and M3. Towards the end, however, the situation reverses. The gap between M1 and M2 becomes larger than the gap between M2 and M3. This implies that M2 increased more rapidly than M1 and M3 in relative terms.

- There is comparatively more volatility in the monetary aggregates in recent years than there was before 2020.

Apart from checking the trends, the use of any certain type of monetary aggregate in an analysis is to be justified in the context of the economic problem being investigated. One measure might be more theoretically suitable to be used than the other for a given economic model.